Exploring DigiLife Fintech Innovations: A Modern Approach to Financial Technology

Embark on a journey through the realm of DigiLife Fintech Innovations, where cutting-edge technology meets financial solutions in a seamless blend of innovation and expertise.

Delve deeper into the evolution, products, technology, and impact of DigiLife as we uncover the intricacies of the fintech landscape.

Introduction to DigiLife Fintech Innovations

DigiLife Fintech Innovations is a cutting-edge financial technology company that specializes in developing innovative solutions for the digital world. Fintech innovations play a crucial role in transforming traditional financial services by leveraging technology to improve efficiency, accessibility, and user experience.

DigiLife is at the forefront of this revolution, offering a wide range of services that cater to the evolving needs of consumers and businesses in the fintech sector.

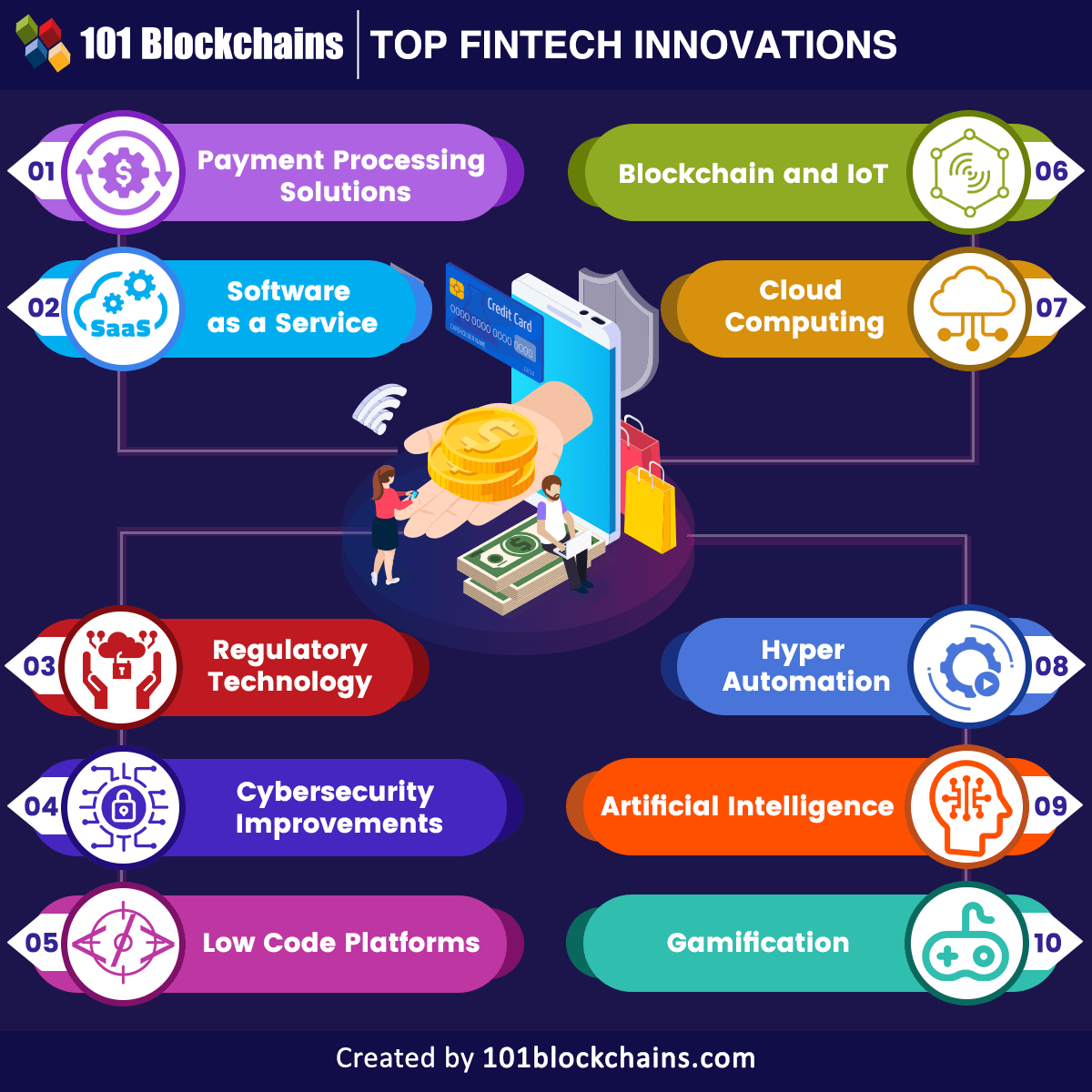

The Significance of Fintech Innovations in the Digital World

Fintech innovations have revolutionized the way financial services are delivered, making them more convenient, cost-effective, and secure. With the rise of digital transactions and online banking, fintech solutions have become essential in enabling seamless and efficient financial operations. These innovations not only benefit consumers by providing personalized services but also empower businesses to streamline their processes and enhance their competitiveness in the digital landscape.

The Role of DigiLife in the Fintech Sector

DigiLife plays a pivotal role in driving fintech advancements by developing cutting-edge solutions that address the diverse needs of its clients. From digital payment systems to automated investment platforms, DigiLife offers a comprehensive suite of fintech services that are designed to optimize financial operations and drive growth.

By leveraging technology and innovation, DigiLife is committed to shaping the future of finance and empowering individuals and businesses to thrive in the digital age.

Evolution of DigiLife Fintech Innovations

DigiLife has come a long way in the fintech sector, constantly evolving to meet the changing needs of its customers and the industry as a whole. Let’s trace the historical development of DigiLife and explore the key milestones and innovations that have shaped its journey.

Establishment and Early Growth

DigiLife was founded in 2010 as a small startup focusing on providing digital financial solutions to consumers. With a team of innovative minds, the company quickly gained traction in the market by offering user-friendly mobile banking applications and online payment systems.

Expansion into Blockchain Technology

In 2015, DigiLife made a significant move by integrating blockchain technology into its services. This allowed for secure and transparent transactions, paving the way for decentralized finance solutions. The company’s early adoption of blockchain set it apart from competitors and solidified its position as a fintech leader.

Adapting to Mobile Payment Trends

As the fintech landscape continued to evolve, DigiLife recognized the growing importance of mobile payments. In response, the company developed cutting-edge mobile wallet solutions that enabled seamless transactions and enhanced user experience. This strategic shift towards mobile payment technology further propelled DigiLife’s growth and relevance in the industry.

Embracing AI and Machine Learning

In recent years, DigiLife has embraced artificial intelligence and machine learning to enhance its financial services. By leveraging data analytics and automation, the company has been able to offer personalized financial advice, risk assessment, and fraud detection to its customers.

This forward-thinking approach has not only improved operational efficiency but also strengthened customer trust in DigiLife’s services.

Future Outlook

Looking ahead, DigiLife continues to stay at the forefront of fintech innovation by exploring emerging technologies such as quantum computing, IoT, and biometrics. By staying agile and responsive to market trends, DigiLife is well-positioned to shape the future of digital finance and make a lasting impact on the fintech industry.

Products and Services Offered by DigiLife

DigiLife offers a range of innovative fintech products and services designed to meet the evolving needs of customers in the digital age.

DigiPay

- DigiPay is a secure digital payment platform that allows users to make seamless transactions online and in-store.

- Users can link their bank accounts, credit cards, and other payment methods for convenient and efficient transactions.

- The platform prioritizes security and encryption to ensure the safety of users’ financial information.

DigiInvest

- DigiInvest is an investment platform that provides users with access to a diverse range of investment opportunities.

- Users can choose from various investment options, including stocks, bonds, mutual funds, and more, based on their risk tolerance and financial goals.

- The platform offers real-time market data and insights to help users make informed investment decisions.

DigiBudget

- DigiBudget is a personal finance management tool that helps users track their income, expenses, and savings goals.

- Users can set budgets, receive spending alerts, and visualize their financial health through interactive dashboards.

- The platform offers personalized recommendations to help users optimize their financial habits and achieve their financial goals.

Technology and Innovation at DigiLife

DigiLife Fintech Innovations stays at the forefront of technological advancements to drive innovation in the fintech industry. By leveraging cutting-edge technologies, DigiLife enhances its solutions to provide efficient and secure financial services to its customers.

Artificial Intelligence and Machine Learning

DigiLife utilizes artificial intelligence and machine learning algorithms to analyze vast amounts of financial data quickly and accurately. These technologies enable DigiLife to personalize services, detect fraud, and make data-driven decisions in real-time.

Blockchain Technology

Blockchain technology is integral to DigiLife’s operations, ensuring transparent and secure transactions for its customers. By utilizing blockchain, DigiLife enhances the trust and reliability of its fintech solutions, especially in areas like digital payments and smart contracts.

Data Analytics and Predictive Modeling

DigiLife leverages data analytics and predictive modeling techniques to gain valuable insights into customer behavior and market trends. By analyzing data effectively, DigiLife can tailor its products and services to meet customer needs and stay ahead of the competition.

Impact of DigiLife Fintech Innovations

DigiLife’s fintech innovations have significantly reshaped the financial industry, revolutionizing the way businesses and consumers interact with financial services. The impact of DigiLife can be seen in various aspects, from consumer behavior to industry practices and future trends.

Enhanced User Experience

DigiLife’s focus on user-centric design and seamless digital experiences has transformed consumer behavior in the financial sector. By offering intuitive mobile apps, personalized financial advice, and quick transaction processing, DigiLife has influenced customers to embrace digital banking solutions and streamline their financial activities.

Efficiency and Cost Savings

Through automation and the use of advanced technologies like artificial intelligence and blockchain, DigiLife has optimized industry practices, leading to increased efficiency and significant cost savings for financial institutions. By reducing manual processes and improving data accuracy, DigiLife’s innovations have set new standards for operational excellence in the financial sector.

Rise of Digital Payments and Security Measures

DigiLife’s advancements in digital payments and cybersecurity have played a crucial role in shaping the future trends of the financial industry. The shift towards contactless payments, biometric authentication, and real-time fraud detection has been accelerated by DigiLife’s innovative solutions, setting the stage for a more secure and convenient financial ecosystem.

Financial Inclusion and Accessibility

DigiLife’s commitment to financial inclusion and accessibility has opened up new opportunities for underserved communities and emerging markets. By offering digital banking services to a wider audience and promoting financial literacy, DigiLife is driving positive social impact and paving the way for a more inclusive financial landscape.

Closing Notes

In conclusion, DigiLife Fintech Innovations stands as a beacon of progress in the financial industry, shaping the future with its forward-thinking approach and groundbreaking solutions.